- Create a Budget

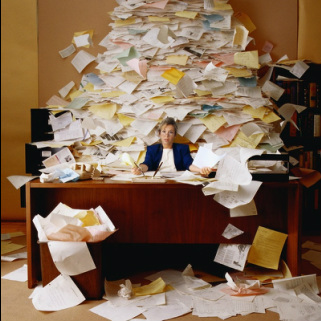

At first, you may think that a budget is only going to add to your financial stress, but it is the best tool you have to get control of your finances and stop worrying about money. A budget allows you to decide when and how you are going to spend your money. It is really a spending plan that makes sure you are reaching your retirement, and savings goals. It can help you find extra money to put towards debt.

The first few months of planning a budget are the most difficult, but once you understand what to do you can often reduce the amount of time you spend on it, and you can really reduce the amount of time you spend worrying about money. Your budget will give you the control that you need over your finances. It is the best tool to help you change your financial situation. Start with just one month’s of expenses and then go from there cutting back in different areas each month until you find the perfect balance.

- Get an Emergency Fund

An emergency fund is money you have set aside to cover unexpected expenses and financial emergencies. Although a car repair can be expensive and stressful, if you know you can tap into your emergency fund to cover it, a lot of the stress will go away. It is also easier to use the money in your budget the way you planned if you know you have the extra money in the bank ready to cover the unexpected emergencies that may crop up. You should have at least $1,000 in the bank until you are out of debt and after that you should work up to about six months of your expenses.

- Get Outside Help

If you are really struggling with getting a handle on your budget and spending issues, do not be afraid to get outside help. You can take classes on basic money management and investing that will help you plan out a budget and do the things you need to succeed financially. A financial planner can help you create a long-term investing strategy that will help you plan for retirement. It is important to realize that you do not have to face the problems alone. If you are feeling overwhelmed by debt you can also use a credit counseling service. You can also take a financial class that coaches you through budgeting and other aspects of your personal finances.

- Determine What You Can Change

Often if you are having financial issues you have an income or a spending issue or a combination of the two. If you know that you do not make enough money, decide what you can do to change the situation. It may mean that you go back to school so you qualify for a higher paying job. If you have a spending problem, and it is an addiction you may want to attend a group like Shopaholics Anonymous to get help dealing with the issues you are facing. Once you have a plan that will help you change your situation permanently, you should be able to reduce your stress. One way that you can prioritize what to cut back on is to determine the hourly cost of your wants. This may make choosing which items to cut much easier. Mastering these twenty financial skills can help reduce your financial stress too.

- Find Positive Aspects of Your Life Each Day

While this may sound like it is not really a solution to your problem, it can make a big difference in the amount of stress that you feel. You can do this by tracking your progress towards your financial goals. Looking at the positive aspects of your life each day can also help you reduce your stress. If possible, try to find some healthy outlets that do not cost a lot of money. Regular exercise and taking care of yourself can reduce your overall stress, which allows you to better focus on the problems and make headway. You can change your financial situation, and you will find it easier to accomplish if you are not worried and afraid all of the time.