With the passage of the Tax Cuts and Jobs Act (TCJA) last December, many Americans are wondering what will actually happen to their tax liabilities when they file their 2018 taxes in 2019. Here’s a recap of some of the major tax provisions in the new tax bill and how they may impact you.

Lower Tax Rates and Changed Income Ranges

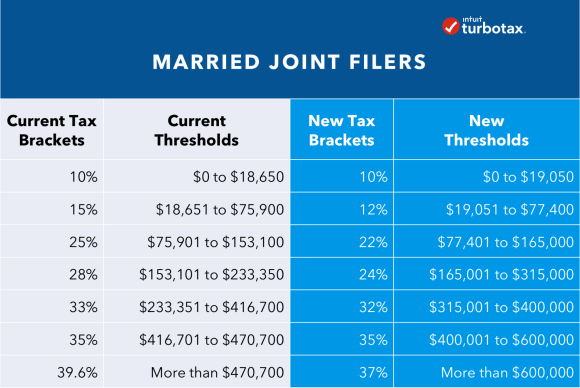

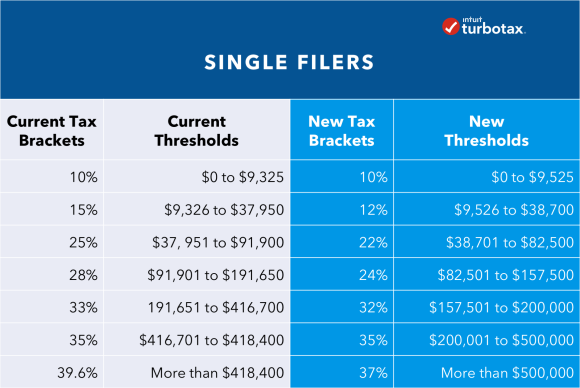

The bill retains the seven tax brackets found in current law but lowers a number of the tax rates. It also changes the income thresholds at which the rates apply.

- The current brackets are: 10%, 15%, 25%, 28%, 33%, 35% and 39.6%

- The new brackets will be: 10%, 12%, 22%, 24%, 32%, 35% and 37%

The income thresholds at which these brackets kick in have changed, as well.

For married joint filers:

For single filers:

Click on this link to see how the new rates will impact you personally:

https://taxfoundation.org/2018-tax-reform-calculator/

Alternative Minimum Tax Exemptions Increased

The bill also eases the burden of the individual alternative minimum tax (AMT) by raising the income exempted from $84,500 (adjusted for inflation) to $109,400 married filing jointly and from $54,300 (adjusted for inflation) to $70,300 for single taxpayers, so fewer taxpayers will pay it.

Tax Relief for Individuals and Families

Increased standard deduction:

The new tax law nearly doubles the standard deduction amount. Single taxpayers will see their standard deductions jump from $6,350 for 2017 taxes to $12,000 for 2018 taxes (the ones you file in 2019).

Married couples filing jointly see an increase from $12,700 to $24,000. These increases mean that fewer people will have to itemize. Today, roughly 30% of taxpayers itemize. Under the new law, this percentage is expected to decrease.

Increased Child Tax Credit:

For, families with children the Child Tax Credit is doubled from $1,000 per child to $2,000. In addition, the amount that is refundable grows from $1,100 to $1,400. The bill also adds a new, non-refundable credit of $500 for dependents other than children. Finally, it raises the income threshold at which these benefits phase out from $110,000 for a married couple to $400,000.

Stay tuned for next month’s newsletter for more updates.