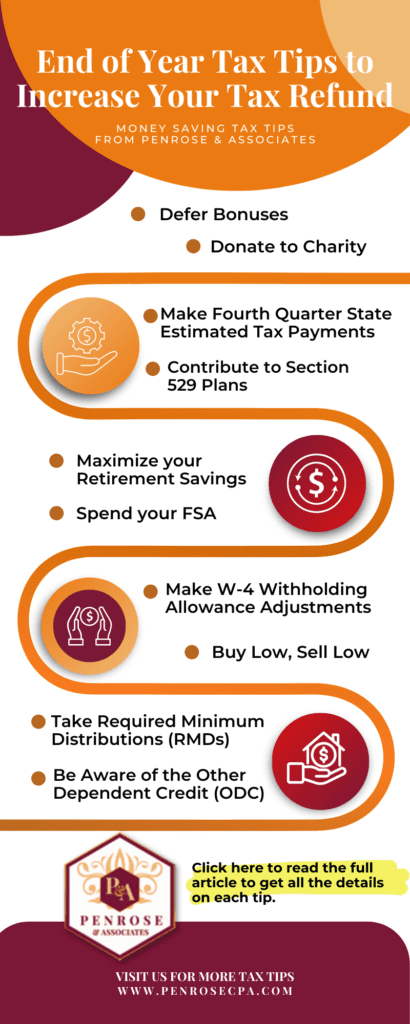

2022 Year End Tax Tips

The tax-filing season will be here before you know it and certain tax matters are best considered before the calendar year ends. The IRS’s much-publicized hiring of tens of thousands of new agents means that this could be a particularly bad year to make a tax misstep. Here are five tips that are worth considering […]

2022 Year End Tax Tips Read More »