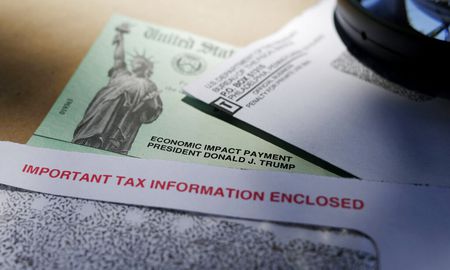

Record Number of Stimulus Check Scams Reveals the IRS

To the millions of people with three rounds of Economic Impact Payments under their belt, stimulus checks may seem like a relic of the early pandemic. But not, apparently, to fraudsters. The IRS revealed this week that it got “a record number of reports” about stimulus check scams in June and July. Amid curiosity around whether there […]

Record Number of Stimulus Check Scams Reveals the IRS Read More »