Small businesses that pay at least half of the health insurance premiums for their employees may be eligible for a tax credit.

The Small Business Health Care Tax Credit provides a federal tax credit of up to 50% of employer-paid health insurance premiums. As with all tax credits, however, there are rules and limitations.

Qualifying for the Small Business Health Care Tax Credit

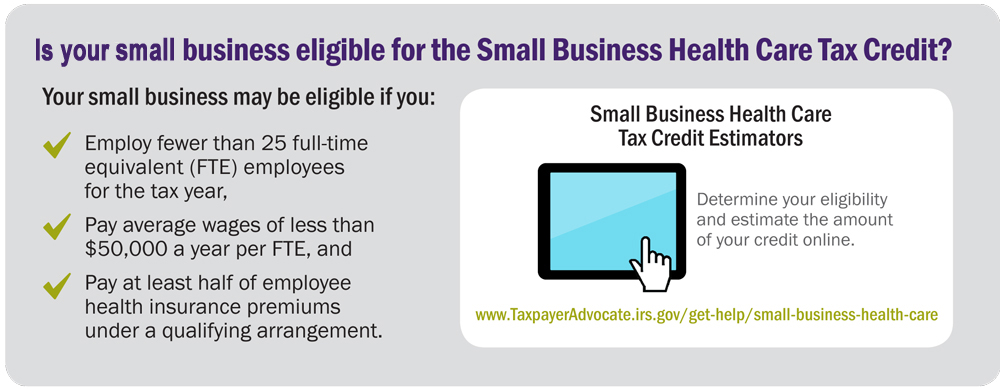

There’s a three-part test to see if a small business qualifies for the health care tax credit:

- The business must have less than 25 full-time equivalent employees;

- The average wage of the employees must be less than $51,600 (for tax year 2015) per full-time equivalent employee;

- Health insurance premiums must be paid through a “qualifying arrangement.”

If all three criteria are met, the small business can take a tax credit for 50% of the eligible health insurance premiums paid during the years 2014, 2015 and future years.

For assistance with determining your qualification contact Patricia Penrose at (201) 816-3691

What is “Qualifying Arrangement”?

A “qualifying arrangement” is generally an arrangement that requires you to pay a uniform percentage (not less than 50%) of the premium cost for each enrolled employee’s health insurance coverage. This 50% test applies only to employee-only health coverage.

So a scenario is which the employers pays half of the employee-only coverage, and the employee pays all the premiums for covering spouse and children would still qualify for the tax credit.

3 Limitations That Reduce the Health Care Tax Credit

Small employers may not qualify for the full amount of the credit. The 50% credit amount represents a maximum amount for the tax credit. The credit is be reduced (or phased out) in the following circumstances:

- The number of full-time equivalent employees exceeds ten,

2. Average annual wages exceeds $25,800 per full-time equivalent for the year 2015, (Average annual wages exceeds $25,900 per full-time equivalent for the year 2016), or

3. Actual health insurance premiums exceed average premiums paid for health coverage in the employer’s area.

Claiming the Health Care Tax Credit

The Health Care Tax Credit will be claimed using Form 8941 and attached to the business’s tax return. The credit will reduce any income tax for the business. The credit is non-refundable (in other words, it can reduce income tax to at most zero). The credit cannot offset payroll tax or self-employment tax liabilities for small business owners.

No Tax Credit for Owners of the Business

The Health Care Tax Credit is not allowed for the owners of corporations, partners in a partnership, and sole proprietors. . For small businesses structured as a C-corporation, the tax credit is not available for employees who own 5% or more of the corporation. For S-corporations, the tax credit is not available for employees who own 2% or more of the S-corporation. Partners, members of LLC treated as a partnership, owners of a single-member LLC, S-corporation shareholders owning 2% or more of an S-corporation, and sole proprietors are all treated as self-employed persons for health insurance purposes, and are eligible for the self-employed health insurance deduction instead of the tax credit.

Can Businesses Take a Deduction for Health Insurance Premiums?

Small businesses can take both a deduction for health insurance premiums and the health care tax credit. However, the amount of the deduction must be reduced by the amount of the tax credit.

Planning Tips for the Health Care Tax Credit

Small businesses should review their accounting systems to make sure they are keeping track of employer-paid and employee-paid health insurance premiums. This will become vitally important as employers may need to report the value of health insurance benefits on employees’ W-2 forms.

Additionally, business owners will want to review how they structure their health benefits. For example, owners may want to revise what percentage of health insurance premiums they want to pay so as to become eligible for the tax credit.

For assistance with determining your qualification contact Patricia Penrose at (201) 816-3691