Each month Penrose & Associates shares timely money-saving Tax Tips - Sign up for our monthly tax tips guide.

2022 Year End Tax Tips

The tax-filing season will be here before you know it and certain tax matters are best considered before the calendar year ends. The IRS’s much-publicized hiring of tens of thousands of new agents means that this could be a particularly bad year to make a tax misstep. Here are five tips that are worth considering...Continue reading→

Head of Household Filing Status – The Benefits

There is no tax filing status that confuses taxpayers more than the one called “head of household.” While this status can increase your tax savings, you must ensure that you follow IRS guidelines fully in order to avoid a potential IRS inquiry or audit. For starters, you can’t be married. Here is a look at what filing as...Continue reading→

COVID tax relief: IRS provides penalty relief for certain 2019 and 2020 returns!

To help struggling taxpayers affected by the COVID-19 pandemic, the Internal Revenue Service today issued Notice 2022-36, which provides penalty relief to most people and businesses who file certain 2019 or 2020 returns late. The IRS is also taking an additional step to help those who paid these penalties already. Nearly 1.6 million taxpayers will automatically...Continue reading→

IRS advises that improperly forgiven Paycheck Protection Program loans are taxable!

The Internal Revenue Service recently issued guidance addressing improper forgiveness of a Paycheck Protection Program loan (PPP loan). The guidance confirms that, when a taxpayer’s loan is forgiven based upon misrepresentations or omissions, the taxpayer is not eligible to exclude the forgiveness from income and must include in income the portion of the loan proceeds...Continue reading→

2022 SUMMER TAX BREAKS AND TIPS

Summer 2022 and taxes may be the last thing on your mind, but giving tax breaks a little bit of thought now could save you a lot of money when tax season comes around again. Read on for summertime tax tips that might help you save money at tax time. Summertime gives way to many changes and...Continue reading→

9 Tax Deductions Every Freelancer and Small Business Owner Needs on Their Radar

9 Tax Deductions Every Freelancer and Small Business Owner Needs on Their Radar Running a small business comes with its challenges. You have to navigate business licenses, contracts, marketing, and, perhaps the most daunting task of all, taxes. When you’re a W-2 employee, April 15 is usually pretty simple — fire up TurboTax, pop in your information,...Continue reading→

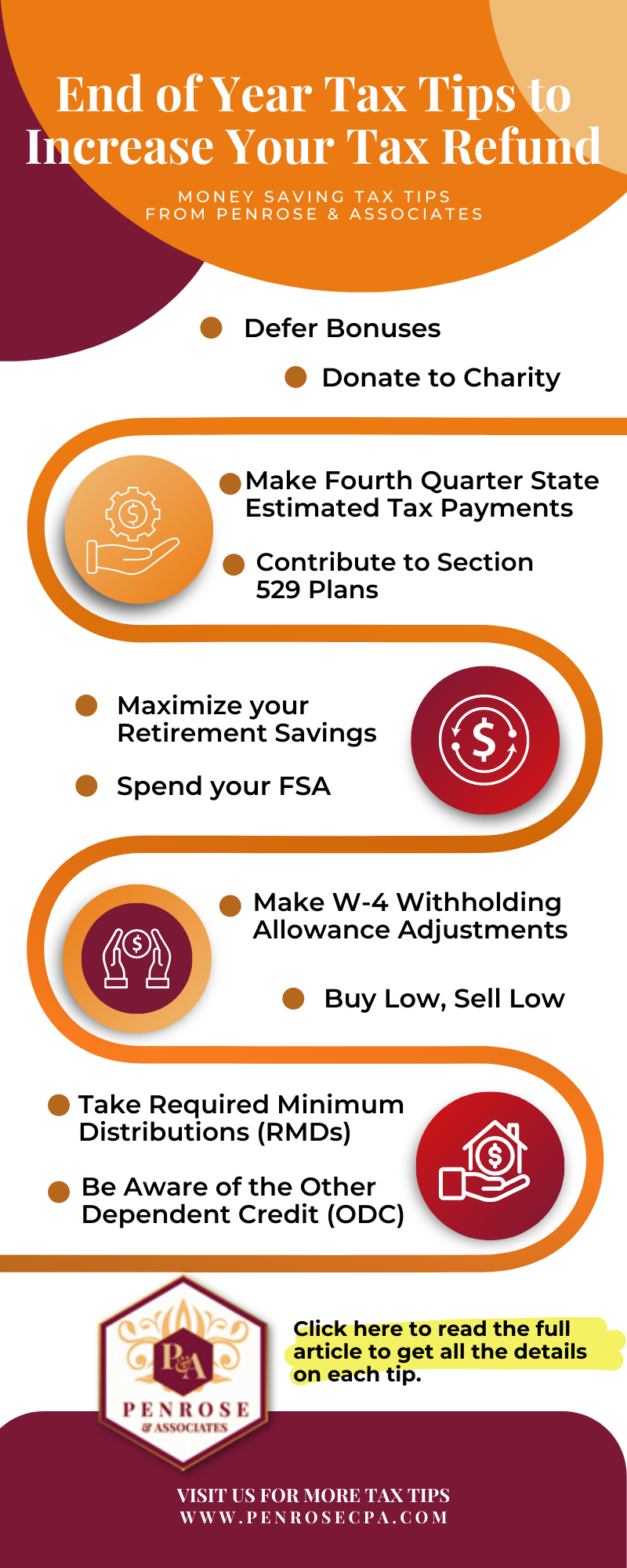

End of Year Tax Tips to Increase Your Tax Refund

It’s hard to believe that we’re in the last month of the year! With 2021 coming to an end, now is a great time to make some easy and smart tax moves to help lower your tax bill and increase your tax refund when you file. Start compiling all of your receipts for any tax-deductible expenses...Continue reading→

Tax Credit – What Is a Tax Credit?

A tax credit is an amount of money that taxpayers can subtract directly from taxes owed to their government. Unlike deductions, which reduce the amount of taxable income, tax credits reduce the actual amount of tax owed. The value of a tax credit depends on the nature of the credit; certain types of tax credits are granted to individuals or businesses in...Continue reading→

Capital Gains Tax – How to Avoid or Minimize

It’s easy to get caught up in choosing investments and forget about the tax consequences, particularly, capital gains tax. After all, picking the right stock or mutual fund can be difficult enough without worrying about after-tax returns. But it’s important to keep consequences in mind, especially for day traders and others taking advantage of the...Continue reading→

America’s Average Debt by Generation

Generation X is often overlooked in the debates comparing baby boomers and the younger millennials and Gen Z. Here’s one way that Gen X stands out, though it’s probably not for the reason this neglected bunch would like: By most measures, the so-called slackers who came of age in the 1980s currently have significantly more debt than their older...Continue reading→