Each month Penrose & Associates shares timely money-saving Tax Tips - Sign up for our monthly tax tips guide.

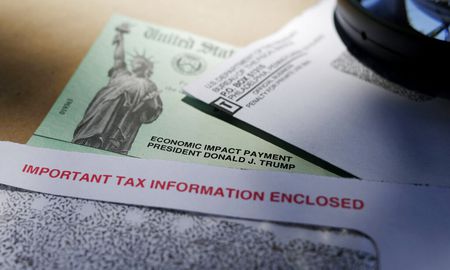

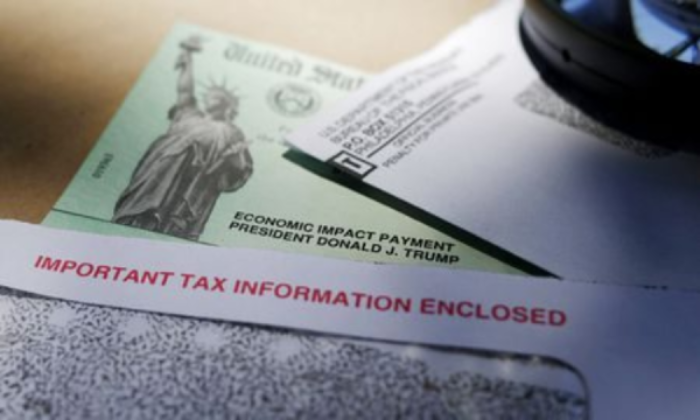

Record Number of Stimulus Check Scams Reveals the IRS

To the millions of people with three rounds of Economic Impact Payments under their belt, stimulus checks may seem like a relic of the early pandemic. But not, apparently, to fraudsters. The IRS revealed this week that it got “a record number of reports” about stimulus check scams in June and July. Amid curiosity around whether there...Continue reading→

How the Expanded Child Tax Credit Payments Work

The Biden administration has begun to distribute expanded child tax credit payments, giving parents on average $423 this month, with payments continuing through the end of the year. President Joe Biden increased the size of the tax credit as part of his $1.9 trillion coronavirus relief package, as well as making it fully available to families without any tax...Continue reading→

Cryptocurrency – What is it and How is it Taxed?

Here’s What You Need to Know Cryptocurrency has headlined many news articles, served as the subject of social media posts, and gained significant traction in mainstream culture. Bitcoin, the first digital currency, has grown exponentially in recent years, with a total market capitalization growing from a modest $10 billion in July 2016 to over $1.1...Continue reading→

New Unemployment Benefits: Who Qualifies and When Payments Start

When the extended programs included in the CARES Act came to an end millions of Americans lost their unemployment benefits. Fortunately, Congress has passed a new relief package that, in addition to introducing second stimulus checks and money for vaccine distribution, further extends unemployment benefits to out-of-work Americans. And not a moment too soon. While unemployment benefits...Continue reading→

What to Do if You Haven’t Received Your Second Stimulus Check Yet

After much political back and forth—and about nine months after the first checks started going out—the second round of stimulus checks is finally hitting Americans’ bank accounts. Many people have tweeted that they’ve already received the second payment, but there are also lots of people concerned about why they haven’t. This time, the checks are...Continue reading→

2020 YEAR END TAX TIPS

Don’t let the holidays distract you from last-minute opportunities to reduce your 2020 tax bill. Some tactics are only in play for 2020, thanks to the federal CARES Act, so this is the only chance you’ll have to capitalize on them. Here are a few tips for your 2020 year end: Give generously In...Continue reading→

More on Working from Home – What Remote Workers Need to Know Before Filing for 2020

So you’ve been working from home this year as a result of the pandemic. Maybe your office went entirely remote and you’ve been having daily Zoom meetings with coworkers and clients. Or perhaps you were laid off and are now doing freelance or contract work from the comfort of your own home. With tax season...Continue reading→

IRS Taxpayer Relief Initiative

The IRS reviewed its collection activities to see how it could provide relief for taxpayers who owe taxes but are struggling financially because of the pandemic. The agency is expanding taxpayer options for making payments and other ways to resolve tax debt. Taxpayers who owe taxes always had options to get help through payment plans...Continue reading→

Tax Implications of Working from Home During COVID-19

Because of COVID-19, millions of people no longer go to the office but work from home instead, where they have had to set up workstations with desks, printers, high-speed internet, and other pricey items, often paid for out of their own pockets. Many other workers have temporarily (or maybe permanently) fled expensive big cities for...Continue reading→

Watch out for Tax Scams in 2020

Most of us find it nerve-wracking enough that we’re forced to focus on gathering our piles of paperwork to fill out our tax returns. Now adding to our stress, we must watch out for tax season scam artists, too. The crooks are everywhere from the gym parking lot to the latest emails and text messages. Fraudsters want...Continue reading→